Africa: So poor, yet so rich

As leaders gather for the first ever U.S-Africa summit at the White House, one question on the mind of most observers is: Why is Africa so rich, yet so poor?

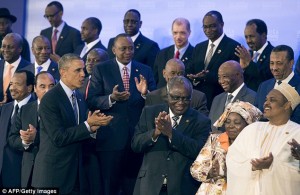

The guest list at the recently concluded US-Africa summit included leaders from more than 50 African Nations. Zimbabwe’s Robert Mugabe was not invited at a summit the White House promoted as the largest-ever gathering of African leaders in the United States.

The guest list at the recently concluded US-Africa summit included leaders from more than 50 African Nations. Zimbabwe’s Robert Mugabe was not invited at a summit the White House promoted as the largest-ever gathering of African leaders in the United States.

Africa is obviously poor, and its poverty persists in the midst of a wealth of natural resources, estimated by the United Nations Economic Commission on Africa as including 12 percent of the world’s oil reserves, 42 percent of its gold, 80 to 90 percent of chromium and platinum group metals, and 60 percent of arable land in addition to vast timber resources.

President Obama’s opening speech at the summit avoided the prickly issues of poverty and money laundering, but he opened with: “I stand before you as the president of the United States, a proud American. I also stand before you as the son of a man from Africa.”

President Obama’s opening speech at the summit avoided the prickly issues of poverty and money laundering, but he opened with: “I stand before you as the president of the United States, a proud American. I also stand before you as the son of a man from Africa.”

He also said: “Our faith traditions remind us of the inherent dignity of every human being and that our work as nations must be rooted in empathy and compassion for each other, as brothers and as sisters.”

After his speech, many of the leaders were later photographed in the White House, posing for individual portraits with Obama and the First Lady. But the truth remains, why is Africa so rich, yet so poor? Briggs Bomba who coordinates TrustAfrica’s work to curb illicit financial flows out of Africa, made it very clear in his report. He said: “Investment and trade in Africa’s resources sector is on the rise, largely accounting for the sustained GDP growth rates witnessed over the last decade. The Economist magazine has reported increased foreign direct investment into Africa, rising from U.S. $15 billion in 2002, to $37 billion in 2006 to $46 billion in 2012. While trade with China alone went up from $11 billion in 2003, to $166 billion in 2012.

After his speech, many of the leaders were later photographed in the White House, posing for individual portraits with Obama and the First Lady. But the truth remains, why is Africa so rich, yet so poor? Briggs Bomba who coordinates TrustAfrica’s work to curb illicit financial flows out of Africa, made it very clear in his report. He said: “Investment and trade in Africa’s resources sector is on the rise, largely accounting for the sustained GDP growth rates witnessed over the last decade. The Economist magazine has reported increased foreign direct investment into Africa, rising from U.S. $15 billion in 2002, to $37 billion in 2006 to $46 billion in 2012. While trade with China alone went up from $11 billion in 2003, to $166 billion in 2012.

In spite of this fantastic news about growth and economic developments in Africa, you can hardly point to an equal change in human development and fundamental economic transformation. A lot of attention is given to vain debates and talks over aid effectiveness, multi-lateral and bi-lateral loans.”

The question that is being asked by many – especially young people of African origin is: Why are we so poor, yet we are so rich?

The disparity between sustained GDP growth rates and Africa’s seemingly obstinate and perverse state of underdevelopment, extreme poverty and deepening inequality brings to the fore issues of inclusivity and responsible governance of domestic resources.

It is multi-national corporations and a few local elites which are benefiting disproportionately from the reported growth – exacerbating inequality and further reinforcing the characteristic “enclave economy” structural defect of most African economies

It is multi-national corporations and a few local elites which are benefiting disproportionately from the reported growth – exacerbating inequality and further reinforcing the characteristic “enclave economy” structural defect of most African economies

By exploiting weaknesses in investment contracts and loopholes in valuation, pricing and taxation regimes, corporations are able to use all sorts of devices to minimize their tax exposure and illicitly move capital out of the region to preferred “tax haven” jurisdictions. These illicit flows rob poor countries of greatly-needed public revenue that could be mobilized and invested to fight poverty, build infrastructure, improve livelihoods and finance development.

According to Briggs Bomba: “A new study of the South African diamond sector by Sarah Bracking and Khadija Sharife provides alarming figures showing that revenue which accrues to the state from the diamond trade is pitiful. In 2012, diamond sales in South Africa brought in $1,2 billion yet the government collected only $11 million dollars in tax.

Massive potential revenue was lost through trade mis-pricing and value manipulation. In the study, Sharife and Bracking calculate that the diamond giant, De Beers, mis-invoiced $2.8 billion dollars worth of stones in recent years – figures that De Beers has not refuted up to now. This hemorrhage of illicit flows affects virtually all key economic sectors, including agriculture, financial services and wildlife and tourism.”

Massive potential revenue was lost through trade mis-pricing and value manipulation. In the study, Sharife and Bracking calculate that the diamond giant, De Beers, mis-invoiced $2.8 billion dollars worth of stones in recent years – figures that De Beers has not refuted up to now. This hemorrhage of illicit flows affects virtually all key economic sectors, including agriculture, financial services and wildlife and tourism.”

In another recent report, the African Development Bank and Global Financial Integrity demonstrate that Africa is actually a net creditor to the developed world due to illicit flows. An estimated $1.2 trillion to $1.4 trillion was lost from Africa in the 30-year period between 1980 and 2009.

What is worrying about the rate of these flows is that it has escalated in recent years, hence the need for comprehensive action now to stem the leakages. Their impact on development cannot be underestimated, not only because they represent a heavy opportunity cost to local development, but also because they exacerbate the debt crisis already crippling most Africa countries, with states turning to loans which in practical terms can never be repaid, and mortgaging natural resources on terrible terms in order to finance development.